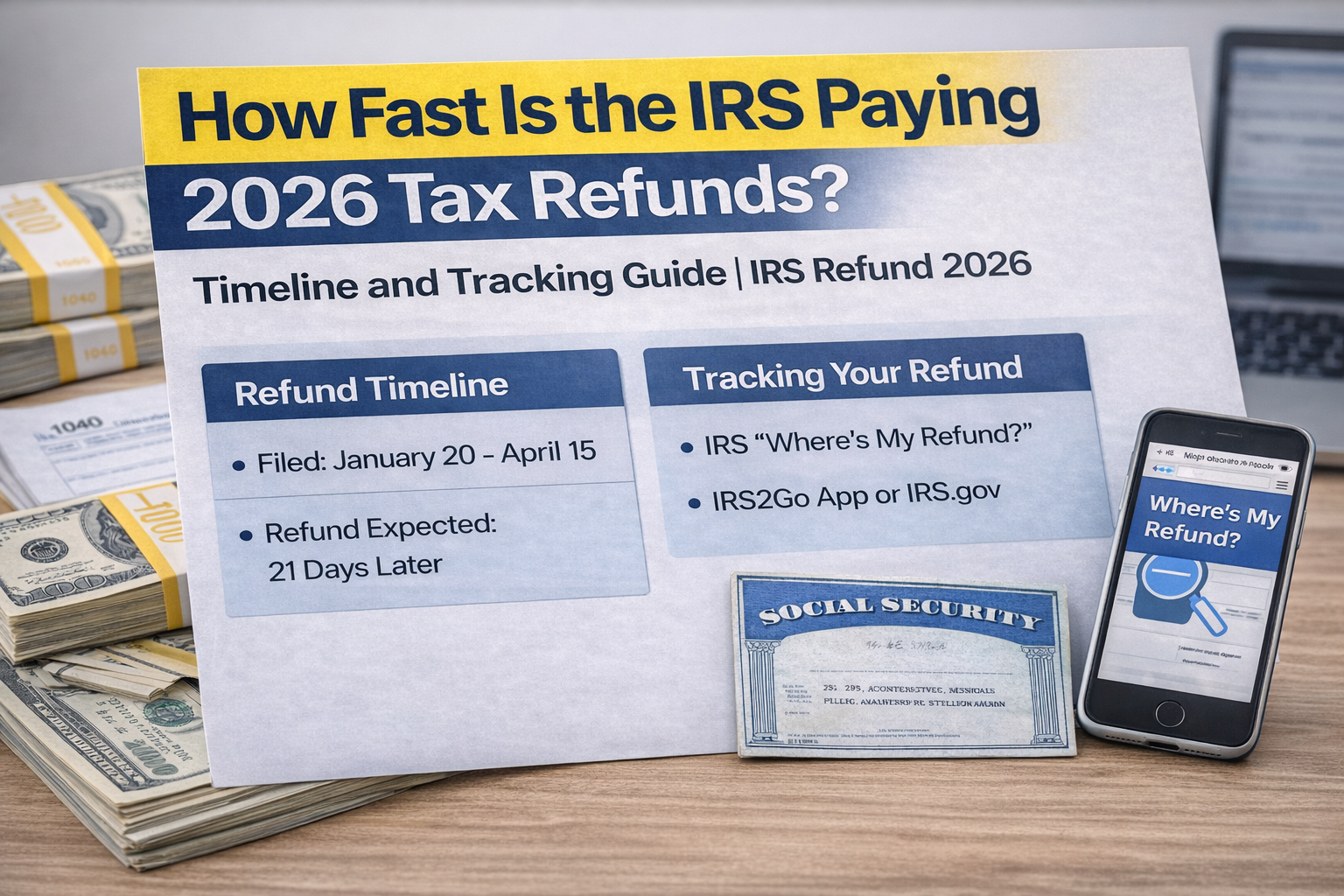

As the 2026 tax season moves forward, millions of Americans are asking one important question: How fast is the IRS paying tax refunds in 2026? With inflation pressures and rising living costs, taxpayers are closely watching refund timelines.

Here’s a complete news-style IRS Refund 2026 timeline and tracking guide, covering payment speed, delays, and how to check your status safely.

IRS Refund 2026: What We Know So Far

The Internal Revenue Service began processing 2025 tax year returns at the start of the 2026 filing season. According to standard IRS guidance, most electronic filers choosing direct deposit are receiving refunds within 21 days.

However, refund timing depends on several factors, including filing method, tax credits claimed, and verification requirements.

How Fast Are 2026 IRS Refunds Being Paid?

Current processing estimates show:

- E-file + Direct Deposit: Usually within 7 to 21 days

- E-file + Paper Check: Around 3 to 4 weeks

- Paper Return + Paper Check: 6 to 8 weeks or longer

The IRS continues to emphasize electronic filing as the fastest and safest option.

Why Some Refunds Are Taking Longer

Not every refund moves through automatic processing. Some returns require manual review. Common reasons include:

- Errors in Social Security numbers

- Mismatched income data

- Math mistakes

- Identity verification checks

- Claims for refundable credits

Taxpayers claiming the Earned Income Tax Credit or Additional Child Tax Credit may see refunds held until mid-February due to anti-fraud review rules.

How to Track Your IRS Refund in 2026

The IRS provides an official online tracking tool called “Where’s My Refund?” available through the Internal Revenue Service website.

To check your refund status, you’ll need:

- Your Social Security Number

- Filing status

- Exact refund amount

Refund status updates typically show one of three stages:

- Return Received

- Refund Approved

- Refund Sent

Updates are made once daily.

IRS2Go App: Mobile Refund Tracking

Taxpayers can also track refunds using the official IRS2Go mobile app. The app allows users to:

- Check refund progress

- Make tax payments

- Access free tax help tools

This remains one of the safest ways to monitor refund activity without calling the IRS.

What Could Delay Your Refund?

While many refunds arrive within three weeks, delays can occur due to:

- Identity verification letters

- Incorrect banking details

- Amended tax returns

- Outstanding federal or state debts

- Random fraud screening reviews

If direct deposit information is incorrect, banks may reject the payment, adding additional processing time.

Estimated 2026 IRS Refund Timeline

Based on current processing patterns:

- Late January Filers: Early to Mid February refunds

- Early February Filers: Mid to Late February refunds

- Mid February Filers: Early March refunds

- March Filers: Typically within 2 to 3 weeks of filing

Actual timing may vary depending on return accuracy and IRS review requirements.

Direct Deposit vs Paper Check: Which Is Faster?

Direct deposit remains the fastest method. It is:

- Secure

- Reliable

- Less prone to mailing delays

Paper checks may take longer due to postal processing times.

What To Do If Your Refund Is Delayed

If more than 21 days have passed since e-filing:

- Check the official IRS tracking tool

- Review any IRS mail notices

- Confirm your bank account details

- Contact the IRS only if instructed

Most delays are resolved automatically without needing phone support.

Final IRS Refund 2026 Outlook

The Internal Revenue Service continues improving digital systems to speed up tax processing in 2026. Early data suggests that taxpayers who file electronically and select direct deposit are still receiving refunds within the expected 21-day window.

However, accuracy remains critical. Even small mistakes can trigger manual reviews and slow payment.

For the fastest refund in 2026:

- File early

- E-file instead of mailing

- Choose direct deposit

- Double-check all personal and income details

Taxpayers are encouraged to rely only on official IRS tools for updates and avoid misinformation circulating on social media.