If you are planning to file your taxes this year, understanding the IRS Refund Schedule 2026 is very important. Every year, millions of Americans wait eagerly for their tax refunds from the Internal Revenue Service. Knowing the estimated payment dates, refund timelines, and average refund amounts can help you manage your finances better.

In this detailed guide, we will explain the expected IRS refund schedule for 2026, estimated payment amounts, processing times, and how you can receive your refund faster.

What Is the IRS Refund Schedule 2026?

The IRS refund schedule is an estimated timeline showing when taxpayers can expect to receive their tax refunds after filing their returns. The refund schedule depends on several factors such as:

- Filing method (e-file or paper return)

- Direct deposit or paper check option

- Claiming tax credits like EITC or ACTC

- Errors or additional review by IRS

For the 2026 tax season (filing 2025 tax returns), the IRS is expected to begin accepting returns in late January 2026, similar to previous years.

When Will IRS Start Accepting Tax Returns in 2026?

Based on past trends, the Internal Revenue Service typically starts accepting federal tax returns between January 20 and January 27.

📌 Estimated Start Date: January 26, 2026 (Expected)

📌 Tax Filing Deadline: April 15, 2026 (Expected)

If April 15 falls on a weekend or holiday, the deadline may shift by a day or two.

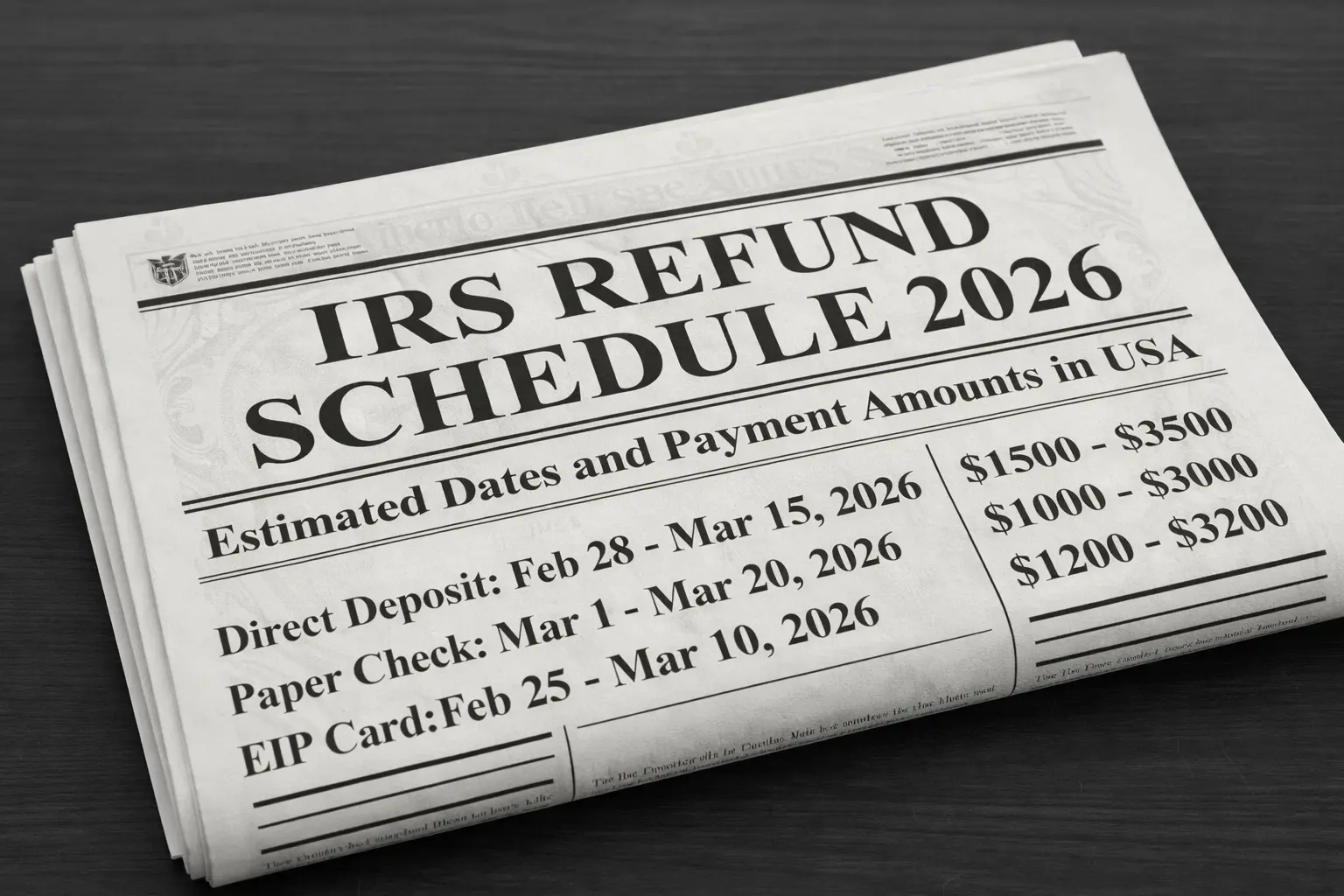

IRS Refund Schedule 2026 (Estimated Direct Deposit Dates)

Here is an estimated refund schedule for taxpayers who file electronically and choose direct deposit:

| Filing Date (2026) | Expected Refund Date (Direct Deposit) |

|---|---|

| Jan 26 – Jan 31 | Feb 16 – Feb 21 |

| Feb 1 – Feb 7 | Feb 23 – Feb 28 |

| Feb 8 – Feb 14 | Mar 2 – Mar 7 |

| Feb 15 – Feb 21 | Mar 9 – Mar 14 |

| Feb 22 – Feb 28 | Mar 16 – Mar 21 |

| Mar 1 – Mar 7 | Mar 23 – Mar 28 |

| Mar 8 – Mar 14 | Mar 30 – Apr 4 |

✅ Most e-filed returns with direct deposit are processed within 21 days.

Refund Schedule for EITC & ACTC Claimers (2026)

If you claim:

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit (ACTC)

The IRS usually holds refunds until mid-February due to fraud prevention laws under the PATH Act.

Taxpayers claiming these credits may see refunds starting from:

📅 February 27 – March 5, 2026 (Estimated)

You can track your refund status using the IRS “Where’s My Refund?” tool on the official IRS website.

How Much Will IRS Refund in 2026? (Estimated Payment Amounts)

Refund amounts vary depending on income, deductions, and tax credits. Based on previous years:

- Average Refund: $3,000 – $3,500

- EITC Refunds: $2,500 – $6,500 (depending on qualifying children)

- Child Tax Credit: Up to $2,000 per child

The final amount depends on your tax situation and filing accuracy.

Fastest Way to Get Your IRS Refund in 2026

If you want your refund quickly, follow these tips:

1. File Electronically (E-File)

E-filing is faster and more secure than mailing paper returns.

2. Choose Direct Deposit

Direct deposit is the fastest payment method. Paper checks can take 4–6 weeks longer.

3. File Early

The earlier you file, the sooner you receive your refund.

4. Avoid Errors

Double-check:

- Social Security Numbers

- Bank account details

- Tax credit eligibility

Errors can delay refunds for weeks or months.

Paper Return Refund Schedule 2026

If you file a paper return, expect longer processing times.

📌 Estimated Processing Time: 6–8 weeks

📌 Refund via Check: Additional 1–2 weeks

Paper filers may not receive refunds until late March or April 2026.

Why Is My IRS Refund Delayed in 2026?

There are several reasons your refund might be delayed:

- Claiming EITC or ACTC

- Incorrect information

- Identity verification issues

- IRS backlog

- Amended return filing

You can check refund status using:

- IRS2Go mobile app

- IRS official website

IRS Refund Status Tools for 2026

The Internal Revenue Service provides official tracking tools:

Where’s My Refund? (Updates once daily)

IRS2Go App

You’ll need:

- Social Security Number

- Filing Status

- Exact Refund Amount

What Happens If You Owe Taxes Instead?

If you owe taxes in 2026:

- Payment deadline remains April 15, 2026

- You can set up installment plans through the IRS

- Penalties apply for late payments

Final Thoughts on IRS Refund Schedule 2026

The IRS Refund Schedule 2026 suggests most taxpayers who e-file and choose direct deposit will receive their refunds within 21 days. Early filers can expect payments as early as mid-February 2026.

To avoid delays:

✔ File electronically

✔ Double-check all information

✔ Choose direct deposit

✔ Track your refund online

Planning ahead and understanding estimated dates can help you manage your finances smoothly in 2026.

FAQs About IRS Refund 2026

Q1: When will IRS send refunds in 2026?

Most refunds will be sent within 21 days after e-filing.

Q2: What is the average IRS refund in 2026?

Estimated average refund is around $3,000–$3,500.

Q3: Why is my 2026 refund delayed?

It may be due to tax credits, errors, or additional review.

Q4: Can I receive my refund faster?

Yes, by e-filing early and choosing direct deposit.